how to add doordash to taxes

Next is to file the taxes. Well walk you through the process for.

Doordash Taxes Does Doordash Take Out Taxes How They Work

First you will need to report your income from doordash on your tax return.

. If youre a Dasher youll need this form to file your taxes. DoorDash will send you tax form 1099-NEC if you earn more than 600. Note that just because you do not get a 1099 you will still need to report your income when filing taxes.

How to pay DoorDash tax. Finally make sure to keep track of your mileage and other expenses related to driving for doordash as you may be able to claim these as deductions as well. Federal income taxes apply to Doordash tips unless their total amounts are below 20.

Once your income tax and self-employment tax amounts have been determined you add the two together. This is your total tax bill. Do you pay taxes on Doordash tips.

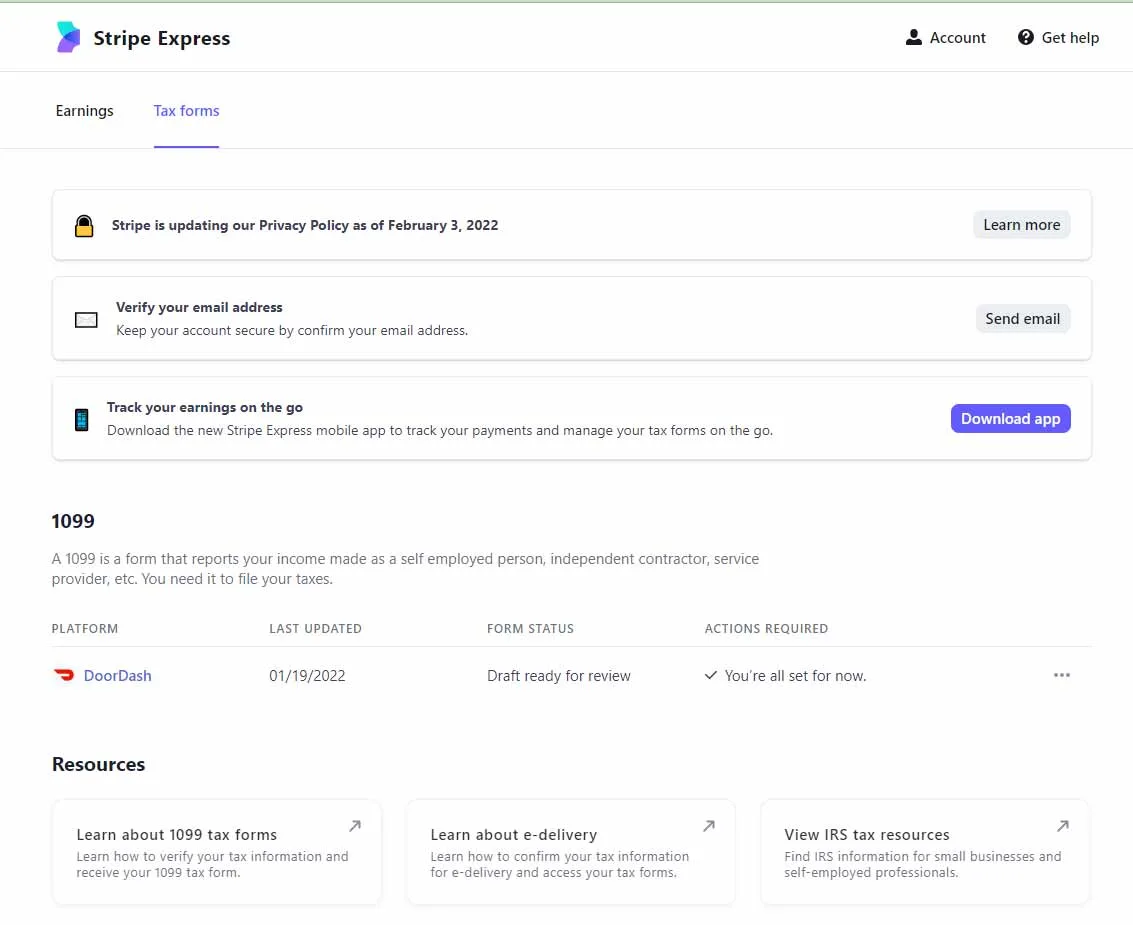

If you dont its automatically sent to your home address as stated in your account. - If you are eligible for e-delivery you will receive an email invitation the subject of the email is Review your draft DoorDash 1099 tax form from Stripe to set up a Stripe Express account. Tax Documents such as the 1099-misc form and last years tax return.

Start with the 4000 of income and subtract your auto mileage expense at the standard mileage rate of 575 cents per mile. Kyrsten Sinema D-Ariz the bill no longer includes a change to the carried interest tax. Tap on Tax Form Delivery to choose the desired form of the 1099 form delivery.

DoorDash currently sends their 1099 forms through Stripe a payment processing company so you will want to keep an eye out for an email inviting you to sign up for a Stripe Express account in order to access this form you. Personal Information such as your photo ID Social Security number card or Individual Taxpayer Identification Number card. Taxes are not withheld automatically and DoorDash calculates the subtotal of the Dashers earnings based on date earnings were deposited and is not based on the date the Dasher completed the dash.

The subject line to look out for is Confirm your tax information with DoorDash Stripe gives you the option to receive your 1099 by either e-delivery or snail mail. You should select a delivery preference at least seven days before the 1099 form needs to be sent. You will simply need your 1099-NEC form which as stated earlier DoorDash will usually automatically send to you well in advance of tax filing time.

Or if you dont have any expenses to report you can use HR Block Deluxe Online. In this video I break down exactly what a doordash delivery driver would pay in taxes if they made 50000 a year. Dont Be Afraid To Cancel Accepted Orders.

All you need to do is contact DoorDash and file a support case. Drivers who make more than 20000 with more than 200 transactions will have to file form 1099-K. Now you have to figure out how much has already been paid in.

If you earned 600 or more you should have received an email invitation in early January the subject of the email is Confirm your tax information with DoorDash from Stripe to set up a Stripe Express account if you did not receive the email invitation but earned 600 or more in 2021 on DoorDash please contact Stripe Express support by clicking. However you still need to report them. E-delivery is the faster option.

So Dashers who earned 600 or more within a calendar year will be given a 1099 form. Because of this Dashers need to have a plan for saving money each month and arent hit with a large surprise come tax time. Please note that DoorDash will typically send independent contractors their tax form by.

You will need the following. DoorDash drivers are expected to file taxes each year like all independent contractors. It will let you see your 1099 online by January 31.

The standard mileage rate allows you to claim a business expense of 575 cents per mile driven for your Doordash and other deliveries for the 2020 tax year 56 cents per mile for the 2021 tax year and 585 cents in 2022. However as a condition of garnering the backing of Sen. You can use HR Block Premium Online to file your return for the upcoming tax season.

File DoorDash Taxes. How to pay DoorDash taxes. I go over how the different tax brackets b.

In this video I will break down how you can file your taxes as a doordash driver and also what you can write-off and how you can calculate how much money you. How Does Taxes Work With Doordash. You will also be able to claim any expenses related to doordash on your return.

How To File 1099 Taxes Properly Uber Doordash Lyft Etc - YouTube. Dashers should set aside 153 of their profits from DoorDash and any other gig work they do. Your cash tips are not included in the information on the 1099-NEC you receive from Doordash.

DoorDash drivers are expected to file taxes each year like all independent contractors. Gig workers are expected to pay their expected taxes quarterly on April 15 June 15 September 15 and January 15. - You must sign up for Stripe Express either through the web portal or mobile app in order to receive your 1099 form as a Merchant.

Yes - Cash and non-cash tips are both taxed by the IRS. DoorDash will send you tax form 1099-NEC if you earn more than 600.

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

How To Get Doordash Tax 1099 Forms Youtube

13 Mistakes Doordash Drivers Should Avoid Doordash Drivers Mistakes

Guide To 1099 Tax Forms For Doordash Dashers And Merchants Stripe Help Support

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

How To Do Taxes For Doordash Drivers 2020 Youtube

The Complete Guide To Doordash 1099 Taxes In Plain English 2022

Doordash 1099 Critical Doordash Tax Information For 2022

Doordash Top Dasher Requirements How It Works What It Means

Doordash 1099 Critical Doordash Tax Information For 2022

Doordash 1099 Critical Doordash Tax Information For 2022

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

How To File 1099 Taxes Properly Uber Doordash Lyft Etc Youtube

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

How Do I Enter My Income Expenses From Doordash 1099 Nec In Turbotax And Deduction For Tax Return Youtube

How To Become A Doordash Driver Doordash Driver Requirements Hyrecar